The Facts About Medicare Advantage Agent Revealed

Table of ContentsGetting My Medicare Advantage Agent To WorkExcitement About Medicare Advantage AgentNot known Details About Medicare Advantage Agent Some Known Questions About Medicare Advantage Agent.

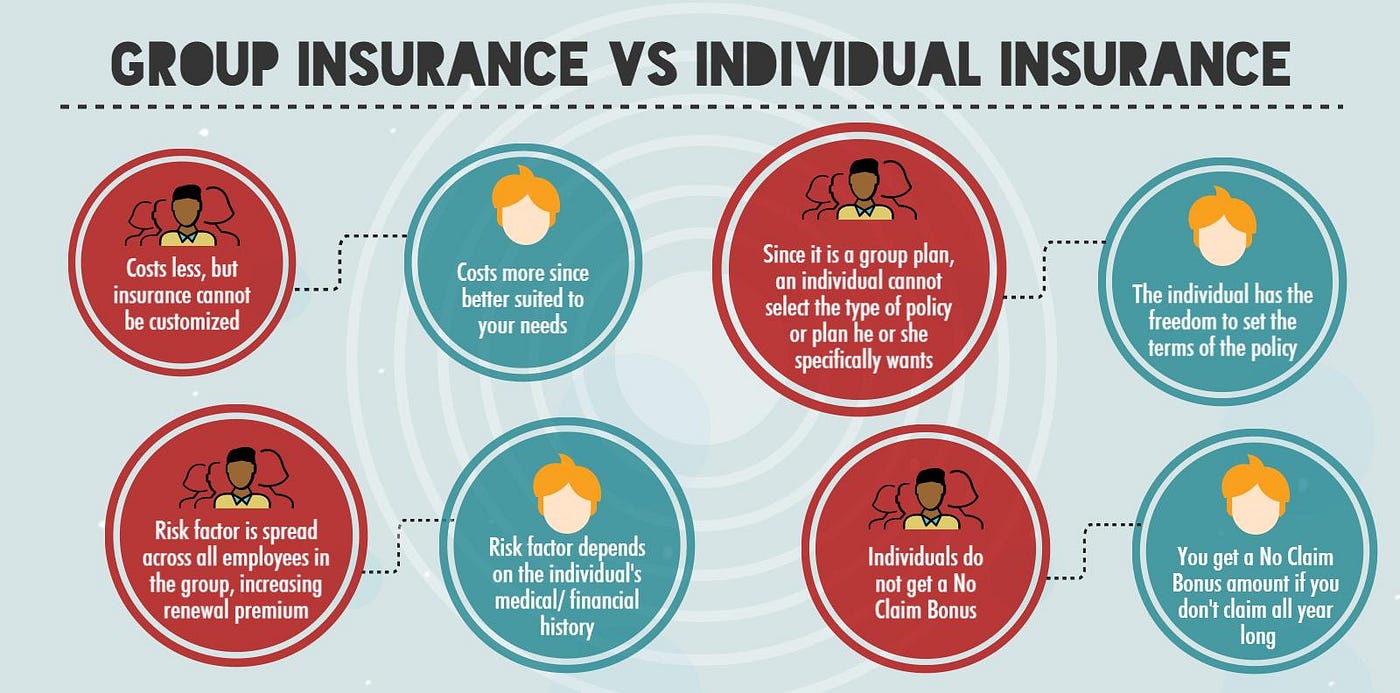

Medical insurance continually ranks as one of one of the most important benefits amongst employees and job applicants alike. Offering a group health insurance plan can help you preserve an affordable benefit over other employers particularly in a limited work market. When workers are stressed over just how they're going to handle a clinical trouble or spend for it - they can become worried and distracted at the workplace.

It additionally offers them peace of mind understanding they can pay for treatment if and when they require it. Medicare Advantage Agent. The choice to offer employee health benefits commonly boils down to an issue of price. Several small company owners neglect that the premium the amount paid to the insurer monthly for protection is normally shared by the company and staff members

Our Medicare Advantage Agent Diaries

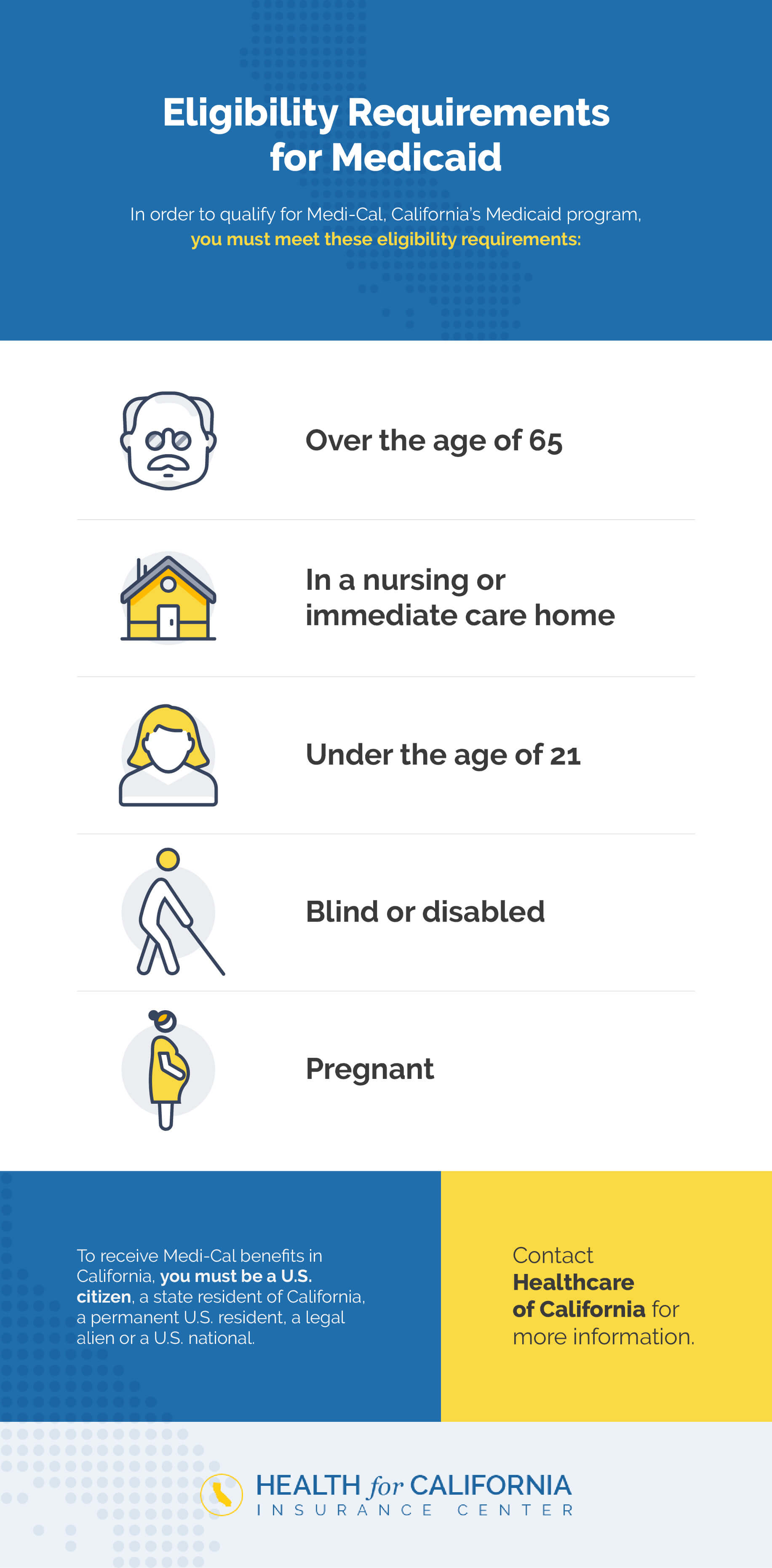

These alternatives can include clinical, dental, vision, and more. To be eligible to sign up in health insurance coverage through the Industry, you: Under the Affordable Care Act (ACA), you have special person security when you are guaranteed through the Health and wellness Insurance Market: Insurers can not decline insurance coverage based on gender or a pre-existing condition.

No one plans to get truly ill or pain. If you acquire health insurance coverage, it can quickly cost you much less cash than going to the health center without it.

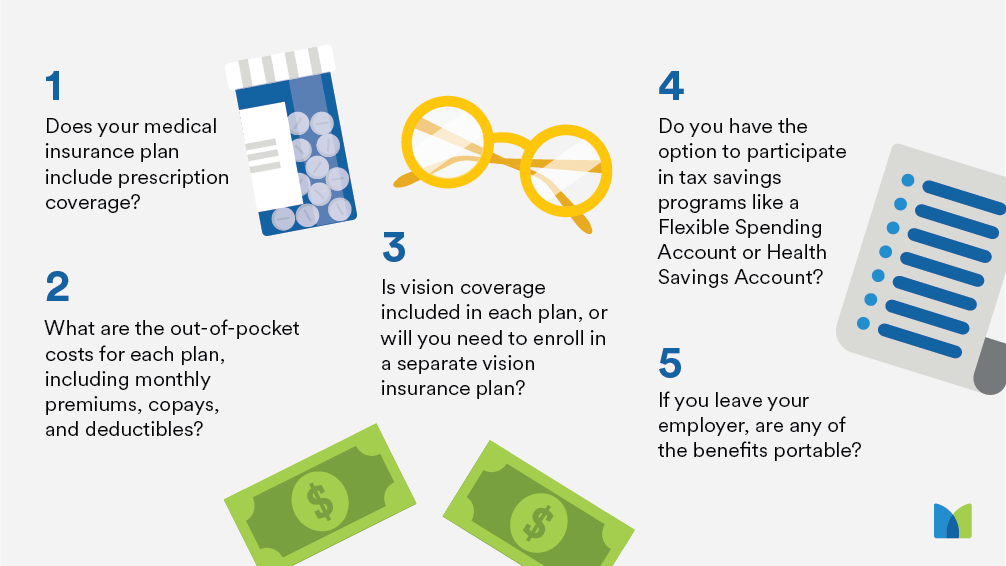

By doing this, you can get healthy and stay healthy. However medical insurance still sets you back cash and picking the appropriate plan for you can be tough. What happens if you currently have insurance policy? The details listed below can aid you recognize the plan you already have and assist you when you are looking for new coverage.

Discover about the kinds of advantages to expect when you have health insurance policy. Discover more concerning the expense of wellness insurance coverage including points like co-pays, co-insurance, deductibles, and premiums.

Some Known Facts About Medicare Advantage Agent.

It will sum up the essential attributes of the plan or protection, such as the protected benefits, cost-sharing stipulations, and coverage restrictions and exemptions. Individuals will get the recap when buying insurance coverage, enrolling in protection, at each brand-new plan year, and within seven service days of asking for a copy from their medical insurance issuer or group wellness strategy.

Many thanks to the this content Affordable Care Act, customers will likewise have a new resource to help them recognize some of the most typical yet confusing jargon utilized in wellness insurance policy (Medicare Advantage Agent). Insurance business and team health plans will be needed to make readily available upon demand a consistent reference of terms commonly made use of in wellness insurance policy protection such as "deductible" and "co-payment"

Wellness insurance coverage in the U.S. can be complex. Lots of people do not have access to excellent protection they can afford, and numerous people do not have any type of health insurance coverage whatsoever. There are lots of broad view modifications that great post to read the federal government requires to make to ensure that medical insurance functions better.

Unknown Facts About Medicare Advantage Agent

"Usually insurance provider additionally make changes to benefits in terms that are generally appropriate this website upon revival of the policy, and so you intend to ensure that you're examining those and you recognize what those changes are and exactly how they might impact you," Carter states. It's also worth checking your benefits if your wellness has transformed recently.

"If consumers can just make the testimonial of their health insurance policy a typical practice, it's something that becomes much easier and less complicated to do over time," says Carter. Exactly how much you utilize your medical insurance depends upon what's going on with your health and wellness. A yearly physical with your primary treatment medical professional can maintain you updated with what's going on in your body, and provide you a concept of what type of wellness treatment you could require in the coming year.